🪓Jio v.s Starlink: The Fault in our Stars

[#19] Tale of Chaos: Mukesh v.s Musk. Space. Satellite. Spectrum. Same arena, rules aren’t. JioSpace Fiber & SpaceX’s Starlink are trekking towards Bharat’s stars; Who’ll Space this Odyssey?

Morning iKyu-riskers! First of all Welcome Back (A note to us). In a recent interaction with our readers, I got to know how much true believers of business & builders love our brutal, handKrafted “documentary-style” business breakdowns and support us on the mission to eradicate the filth of Clickbait Journalism in the world. It can only happen if our readers and inKredilbe subsKribers start carving with the ‘brutal breakdown’ culture to fight this trendy ‘dumb-down’ culture. Our vision is to become the Antidote of Clickbait Journalism, and for our vision to become limitless — we will never make short-form/byte-sized/digestable content EVER. To our exclusive readers, if you truly, from the bottom of your heart, appreciate reading to what’s crafted just as you wanted, support our ‘Subscription-Driven Publication’ business model. And read our first draft Manifesto…

🚨SHORT ANNOUNCEMENT: As I am back from my much needed family retreat from the trenches, we are resuming our handKrafting great brutal stories from today. And I will be full-throttling on our X Threads🧵 with chilling, grifter and awesome breakdown storytelling of startups, business, technology.

Follow us on X to not miss out any tailored business content.

BONUS: Today’s edition is FREE for all; Our returning gesture for our inKredible subsKribers.🙏

Now let’s get into the War of Stars…

“My desires are bounded by these mountains, and if they ever wander hence it is to contemplate the beauty of the heavens, steps by which the soul travels to its primeval abode.”

“This is noble, righteous warfare, for it is wonderfully useful to God to have such an evil race wiped from the face of the earth.”

Don Quixote

Hello iKyu-riskers! Everyone loves a comeback story.

A story that has an underdog character. Who goes against all odds to fight and take what he ‘thinks’ he deserves.

And then we have the rest of the world. The world often talks with you in stories. And how do you respond back?

Metaphorically, they used to say: the one who’s the richest — controls the world.

So want to respond back to the world. Simply respond to the richest.

Makes sense?

Hell nah!

Because these kind of elitist logic only finesses on movie sets. Where entire enigma is your script. Real life doesn’t work on scripts. It works on transactions, trauma and trust. Deadly combination.

THE (K)EY NOTES:

The (K)urrent: Jug Jug JioThe (K)réme: The Big Bang SatCom TheoryThe (K)inK: Evening the Odds

The battleground is more barbaric than ever.

Because in the world full of transactions, trauma and trust — we are going to see a collision.

Collision of two worlds: India’s Richest v.s World’s Richest.

Is it a fair fight?

What kind of fight is this?

Why are they fighting on the first place?

Well, you got to give them space. That’s their battle cry. Literally.

They want SPACE. Not to just rule the nocturnal species but beyond. These two richest are going for a head on collision to connect the world. Through India. Fascinating, isn't it?

Jio’s SpaceFiber and SpaceX’s Starlink is standing on an impasse. Who’s going to take the first shot?

Jio’s discourse is tightening with its customers. While Musk fanboys are toiling to get a premium ‘mission-driven’ narrative starlink connection to do what…Droom-scroll?!

All for a satellite dominance on Indian soil space?

Let’s brutally breakdown🪓 in detail on what’s this entire spectrum chase is all about and how these rich-lords are defining the future of India on today’s Sunday edition of inK by iKyu.

But before we deep dive, let’s begin with India by iKyu…

THE (K)URRENT

JUG JUG JIO…

JioStar Jio🤝Hotstar Merger Deal

The impending merger of JioCinema and Disney+ Hotstar is a seismic shift in India's OTT landscape. Reliance Industries Limited (RIL) aims to consolidate these platforms, creating a streaming behemoth that could dominate the market. With Disney+ Hotstar's 333 million users and JioCinema's rapid growth, this merger could yield over 125,000 hours of content, including coveted sports rights like the IPL, positioning it against giants like Netflix and Amazon Prime.

This strategic move not only streamlines operations but also addresses Disney+ Hotstar's declining subscriber base, which plummeted from 61 million to 35.5 million due to lost content rights. RIL's ability to attract massive viewership through the IPL on JioCinema underscores its potential.

However, the domain squatting incident involving JioHotstar.com raises eyebrows. The domain was registered just before the merger announcement, hinting at a calculated branding strategy or a defensive move against competitors. This reflects RIL's aggressive approach to securing its digital territory, ensuring that it remains a formidable player in the evolving OTT battleground.

I have predicted the name of the OTT Platform that would be after the Merger as “JioStar” on October 23rd, 2024 (You heard it here first) on X.

Mukesh’s VIDYA, Jensen’s NVIDIA

The recent interaction between Mukesh Ambani and Jensen Huang at the NVIDIA AI Summit marked a pivotal moment for India's tech landscape. Their dialogue centered on the collaboration between NVIDIA and Reliance Industries, aimed at establishing robust AI infrastructure in India. Ambani's assertion that "India is ready to lead the world in AI" reflects a bold vision, while Huang emphasized the transformative potential of AI across industries. This partnership is set to leverage Reliance Jio's extensive network and data capabilities alongside NVIDIA's cutting-edge technology, positioning India as a global AI powerhouse. Huang's perspective on the Indian market is optimistic; he sees immense potential for innovation and growth, particularly in sectors like agriculture, healthcare, and education.

The purpose of this interaction was clear: to outline a roadmap for integrating AI into India's economic fabric, enhancing productivity and efficiency. Ambani's remarks about "empowering every Indian with technology" underscore a commitment to democratizing access to advanced tools.

The stakes are high. As both titans strategize their next moves, they must navigate challenges such as infrastructure readiness and regulatory hurdles. The synergy between Reliance and NVIDIA could redefine India's digital future, but it demands execution that matches ambition.

In essence, this meeting wasn't just a handshake; it was a declaration of intent to reshape the technological landscape of India.

THE (K)REMÉ

THE BIG BANG “SATCOM” THEORY…

“In emptiness, there is no suffering.”

Nagarjuna

In the gleaming towers of Mumbai and the rocket labs of California, two titans prepared for a clash that could redefine not just the digital landscape of India, but the very fabric of its society.

On one side stood Mukesh Ambani, India’s richest man, whose Reliance Jio had already disrupted the nation’s telecom sector with seismic force. On the other was Elon Musk, the world’s richest man, whose SpaceX and its Starlink project aimed to envelop the globe in a network of satellites delivering high-speed internet to every inch of the planet.

This was not just a business rivalry; it was a high-stakes duel between ambition and innovation, between domestic might and global prowess. The battleground is India—a market of 1.4 billion people, over half of whom were still awaiting reliable internet access. The prize? Nothing less than the digital future of the world’s largest democracy.

Mukesh Ambani’s Reliance Jio had already rewritten the rules of the game.

“OIL to JIO”

In 2016, Jio entered the Indian telecom market with aggressive pricing strategies that offered data and voice services at fractions of existing costs. Within months, competitors were reeling. Since 2016 to date, Jio had amassed over 472 million subscribers, becoming the largest mobile network operator in India and the third-largest in the world.

But Ambani was not one to rest on his laurels. Recognizing that terrestrial infrastructure could only take connectivity so far—especially in a country as vast and varied as India—he set his sights on the stars. In February 2022, reports emerged that Reliance was working on JioSpace Fiber, a satellite-based broadband service designed to bring high-speed internet to even the most remote regions of the country.

“Data is the new oil,” Ambani had declared at a shareholders’ meeting, his gaze steely with determination. “And we will ensure that every Indian has access to this vital resource, no matter where they are.”

On the other side of the world, Elon Musk was charting his own course to the cosmos. SpaceX’s Starlink project aimed to deploy a constellation of up to 42,000 low-earth orbit satellites, creating a mesh network capable of delivering high-speed internet anywhere on the planet.

INTERSTELLAR LOAD—…

By November 2024, SpaceX’s has launched total of 7292 Starlink satellites, offering services in multiple countries and amassing over a million subscribers globally.

Elon Musk's Starlink is poised to enter the Indian market, having made strides to comply with local regulations. The company is currently seeking the necessary licenses to operate satellite broadband services in India, with a focus on adhering to government data localization rules that require all data to be stored within the country. This move aligns with India's regulatory framework and is expected to facilitate Starlink's launch soon.

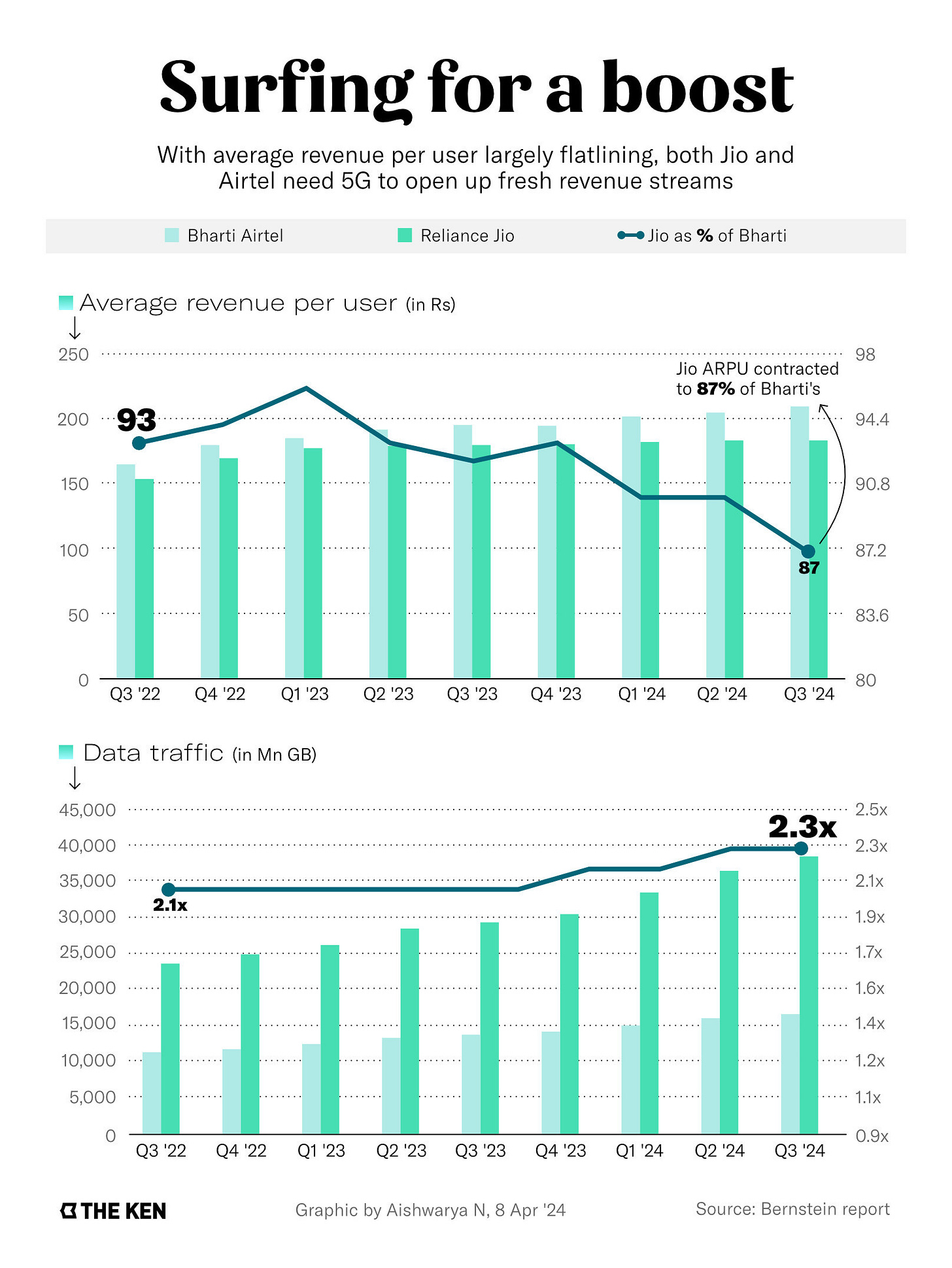

Starlink's entry is anticipated to disrupt the existing telecom landscape dominated by giants like Reliance Jio and Bharti Airtel. With India having some of the lowest internet pricing globally, Starlink's competitive pricing strategy could pose a serious challenge to these established players. Jio currently leads the market with over 14 million wired broadband subscribers and nearly 500 million mobile internet users, while Airtel follows closely behind.

The competition is further intensified by Reliance Jio's lobbying for an auction-based approach to satellite spectrum allocation, contrasting with Starlink's preference for administrative allocation. Jio argues that an auction would ensure a level playing field, allowing traditional telecom services to compete fairly against satellite providers like Starlink.

Reliance Jio has already secured clearances to launch its own satellite broadband service but has yet to do so. The company is concerned about losing customers to Starlink as satellite technology advances and becomes more viable for urban markets. Mukesh Ambani’s strategy historically included offering services at minimal costs to capture market share, a tactic that Musk may also employ given his previous low pricing in markets like Africa.

GENTLE IN THE NIGHT

India was a tantalizing market for Musk—a land where his vision of universal connectivity could find its most profound expression. In 2021, SpaceX began accepting pre-orders for Starlink in India, with plans to launch services by mid-2022. The response was immediate; tens of thousands of Indians signed up, hopeful that Starlink could bridge the digital divide that had long plagued the nation.

But the Indian government was not so easily swayed. Citing concerns over regulatory compliance and national security, the Department of Telecommunications issued a directive in November 2021, ordering SpaceX to stop booking pre-orders until the necessary licenses were obtained.

“India is not just another market,” an unnamed official was quoted as saying in The Economic Times. “We have our own regulatory framework, and every company—foreign or domestic—must adhere to it.”

Musk, never one to back down from a challenge, took to Twitter in his characteristic fashion. “Just figuring out the regulatory approval process,” he quipped, his words tinged with both frustration and resolve.

Ambani watched these developments with keen interest. Reliance Jio had long mastered the art of navigating India’s intricate regulatory landscape, leveraging relationships and an intimate understanding of the bureaucracy to its advantage. While Starlink grappled with red tape, JioSpace Fiber was quietly forging ahead.

By mid-2022, Jio had reportedly entered into partnerships with domestic satellite companies and was lobbying for favorable policies that could give it a competitive edge. Industry insiders whispered about high-level meetings between Reliance executives and government officials, discussions that could shape the future of India’s satellite communications policy.

“Ambani plays chess while others are playing checkers,” remarked Sunil Gupta, a veteran telecom analyst. “He understands that in India, business is as much about relationships and timing as it is about innovation.”

Meanwhile, the existing internet service providers watched with a mixture of dread and resignation. Companies like Bharti Airtel and Vodafone Idea were already reeling from Jio’s aggressive entry into the telecom market. The prospect of competing against both Jio and Starlink in the satellite internet space was akin to facing a storm without shelter.

For the average Indian consumer, the promises were intoxicating. High-speed internet without the constraints of ground infrastructure could revolutionize education, healthcare, commerce, and entertainment.

"PRICE IS POWER. POWER IS POWER!

But all of this is sheltered with one that Indians can be easily pushed away. The Price.

The value-for-money audience of India. Often waits for the affordable class to collapse as soon as the pricing is announced for these products and services and then they start smothering.

Beneath the surface of optimism surrounding Starlink's entry into India, significant questions remain about affordability and market impact. Currently, the cheapest monthly plan offered by Starlink is approximately ₹4,200 (around $50), with a one-time equipment cost of about ₹37,400. This pricing structure poses a challenge in a country where many consumers earn an average monthly income of around ₹15,000.

In contrast, established players like Reliance Jio and Airtel offer much more competitive pricing for their broadband services. For instance, JioFiber plans start at ₹399 per month, while Airtel Xstream Fiber plans begin at ₹499 per month. Given that India is known for having some of the cheapest internet rates globally, Starlink's higher costs may deter potential customers, particularly in rural areas where the need for affordable connectivity is most acute.

Moreover, while Jio has been known for its disruptive pricing strategies, it remains to be seen how they will respond to Starlink's offerings. The entry of Starlink could force Jio to reassess its pricing models to maintain its competitive edge, but this raises concerns about sustainability and profitability in an already price-sensitive market.

Overall, while Starlink's advanced satellite technology promises high-speed internet access, especially in underserved regions, its initial pricing may limit its appeal unless adjustments are made to align more closely with local market expectations.

Then there were concerns about data privacy and sovereignty. Allowing a foreign entity like SpaceX to control a significant portion of India’s communication infrastructure raised alarms among policymakers and security experts.

“We are committed to bringing Starlink to India,” declared Gwynne Shotwell, President and COO of SpaceX, in a press release. “We believe in the transformative power of connectivity and are eager to work with the government to make this vision a reality.”

The stage was set for a titanic struggle—not just between two corporations, but between two visions of the future. Ambani’s approach was grounded, strategic, and deeply intertwined with India’s socio-political fabric. Musk’s was audacious, disruptive, and global in its outlook.

But the complexities of the Indian market were unforgiving. Starlink faced delays in securing spectrum allocations, while JioSpace Fiber encountered technical challenges in integrating satellite and terrestrial networks. The race was becoming as much about endurance as it was about speed.

The economic implications were staggering. According to a report by the Internet and Mobile Association of India, increasing internet penetration by just 10% could boost GDP growth by 1.08%. With over 600 million Indians still offline, the potential for economic transformation was immense.

TL;DR

“The satellite internet business is capital intensive with long payback periods,” noted Rakesh Kapoor, an investment analyst at Goldman Sachs. “Both companies need to demonstrate not just technological feasibility but also a viable business model.”

Then came the geopolitical tremors. Tensions between the U.S. and China escalated, with ripple effects felt globally. India, navigating its own complex relationships, became more protective of its strategic assets. The government tightened regulations on foreign investments in sensitive sectors, adding another layer of complexity for SpaceX. Ambani, ever the strategist, capitalized on the moment. At the 2023 Reliance Annual General Meeting, he unveiled Jio’s vision for a “Digital India,” emphasizing self-reliance and national pride. “We stand at the cusp of a new era,” he proclaimed, his voice resonating through the auditorium.

“An era where India leads not just in consumption but in innovation, in setting the agenda for the world.”

The message was clear: Reliance was not just a business entity but a national champion, and any competition was not just against a company but against India’s sovereign interests.

The (K)inK.

“Internet piK of the week”

A heartfelt message from Late Steven Paul Jobs.

EVENING THE ODDS

Beneath the spectacle of rockets and satellites, billionaires and boardrooms, lies an uncomfortable truth—a kink in the grand tapestry of progress. The race between JioSpace Fiber and Starlink is not merely a contest of technological prowess or market dominance; it is a mirror reflecting the deeper contradictions of our times.

On one side, we have Mukesh Ambani, whose empire is built as much on navigating the corridors of power as it is on business acumen. Reliance’s rise is entwined with a system that rewards proximity over merit, that blurs the lines between public interest and private gain. The aggressive push for JioSpace Fiber is as much about consolidating power as it is about connecting the unconnected.

On the other, we have Elon Musk, the archetype of Silicon Valley’s messianic complex—believing that technology, wielded by the right hands, can solve any problem. Yet, this techno-utopianism often overlooks the messy realities of local contexts, cultures, and the unintended consequences of disruption.

The battle for satellite supremacy risks eclipsing the collaborative potential that could truly transform India’s digital landscape. Instead of a zero-sum game, imagine a scenario where technology is democratized, where policies are crafted not to favor incumbents or gatekeepers but to foster innovation at all levels. In a world grappling with unprecedented wokeism, predictable population collapse, and the erosion of public trust, the pursuit of domination—be it in space or cyberspace—feels increasingly anachronistic. The real challenge is not who can conquer the skies, but who can ground their ambitions in empathy, ethics, and equity.

A reminder that progress is not a straight line drawn by the hands of the few, but a collective journey navigated by the many. It’s a call to reimagine what connectivity means—not just as a technical achievement, but as a shared human endeavour that bridges divides rather than deepening them.

As the satellites continue their silent dance across the night sky, the true measure of success will not be counted in megabits per second or market share percentages. It will be reflected in the lives transformed, the opportunities unlocked, and the futures reimagined.

In the end, the question is not how India’s richest will stand against the world’s richest, but how both can rise to the occasion and serve a greater good. Until then, the kink remains—a flaw not in the stars, but in ourselves.

As a customer, I have sown my choice. What are you reaping?

~vivan.