🪓ZestMoney: Raise NOW, Return NEVER

[#9] Tale of Chaos: Founders QUIT. Failed acquisition. Fractured by Regulations. And still wondering why India's "Buy Now Pay Later (BNPL)" Poster Boy SHUT with shame?

“A ceasefire is a must for the sake of humanity. Ceasefire is important, but it can last only for a very, very, very short time.”

— from someone in the fintech space (maybe).

2023.

What a year for all the Business builders and startup founders…

After a full year of fairy tale🦄 ‘horn’ animals being vortexed in an almost negative narrative regarding “Business Journalism”, they’re back at discussing the big catastrophe in the Indian startup diaspora.

Modern media has made Business journalism a vanity-seeking course, but seeking is still an aspiration for all.

This is not just a normal Rise and Fall story of ZestMoney; this is a wake-up call for future builders to integrate insights and learning into building our nation. Our economy. Pushing the lever of humanity forward.

The (K)ey Notes:

The Kurrent: The Last BlowThe Kréme: The Last SaveThe (K)inK: The Last of Zest

Startup REWIND for December 2023:

"ZestMoney to shut down operations, lay off remaining 150 employees"

— YourStory"Goldman Sachs-backed ZestMoney, once valued at $450M, to shut down"

— TechCrunch."BNPL fintech upstart ZestMoney, last valued at $450Mn, shuts down"

— The Tech Portal.And many more drilling headlines & reports which fail to give a raw, real and brutal picture of the debacle, we call ZestMoney!

Let’s deep dive into the collapse of India’s BNPL Zest…

THE (K)URRENT

THE LAST BLOW…

Founded in January 2016, ZestMoney (ZM) was once a shining star in India's burgeoning Buy Now Pay Later (BNPL) scene. Boasting a valuation of $450 million and partnerships with major retailers, it seemed poised for success, recently announced its shutdown, marking a significant turn in the country's fintech landscape. The Bengaluru-headquartered company had attracted major investors like Goldman Sachs and had raised over $130 million during its eight-year operation. Despite this, ZestMoney faced several critical challenges leading to its closure.

There’s no one reason to investigate and understand the fickle nature of ZestMoney. The turmoil had already begun in the recent months.

In a statement released in May, ZestMoney outlined a strategic shift, emphasising a focus on core digital EMI and personal loan products while discontinuing SaaS and insurance business operations. Over the past six months, the company's digital EMI product has faced challenges, encountering resistance from consumers and crucial partners such as payment aggregators, eCommerce platforms, and non-banking financial companies (NBFCs). [From Multiple reports]

KEY REASONS FOR ZESTMONEY’S CLOSURE:

Regulatory Uncertainty: The Reserve Bank of India (RBI) introduced new regulations in June 2022, significantly impacting non-bank institutions and fintech companies offering BNPL services. These changes affected ZestMoney's operations and led them to seek a buyer, but unfortunately, they were unsuccessful. The Indian government's stringent regulations on digital lending, including a cap on loan tenures and stricter due diligence norms, hampered ZestMoney's ability to operate under its core small-ticket BNPL model.

Leadership SANK: In a setback earlier this year, ZestMoney faced the departure of its three co-founders, Lizzie Chapman, Priya Sharma, and Ashish Anantharaman; the company's founders resigned in May 2023, two months after PhonePe's withdrawal from acquisition talks. The transition to new management brought challenges in maintaining the original vision and strategy, compounded by broader industry challenges.

Zest-Pe-no-trust: ZestMoney entered into talks with PhonePe for a potential acquisition, valued between $200 million and $300 million. However, in March 2023, PhonePe walked away from the deal due to due diligence issues. This left ZestMoney in a precarious position, eventually leading to a reduction in its workforce and an active search for a new buyer.

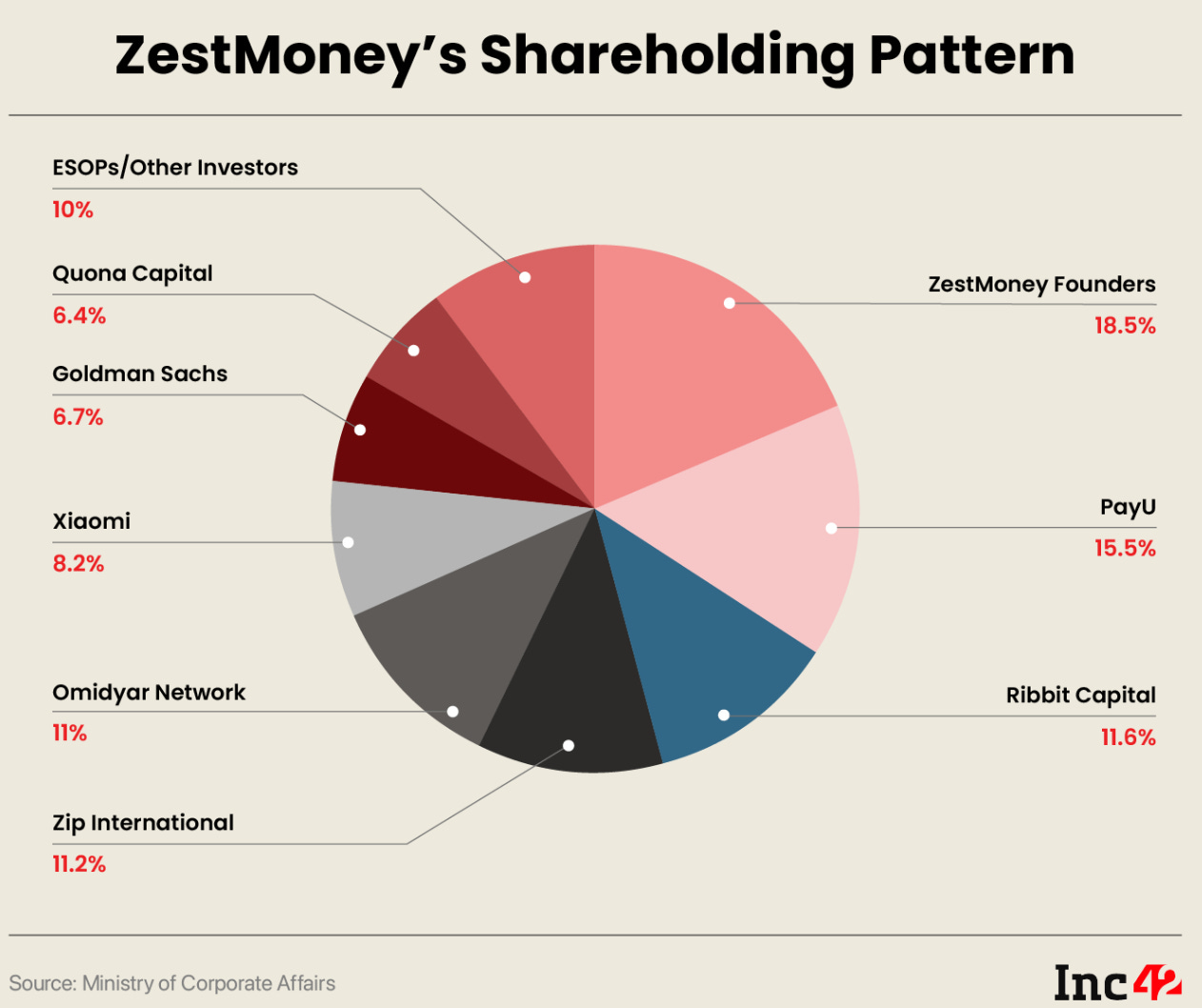

What the FUND?: Although ZestMoney secured significant funding in its early years, it faced difficulties in sustaining operations and adapting to market changes. In August 2023, ZestMoney received a crucial investment of $5 million from existing investors, Prosus, an investor with a 19.4% stake in ZestMoney, wrote off its $38 million investment as the company grappled with its financial downturn; but this was not enough to sustain the business in the long term. Mounting losses and a slowdown in growth, coupled with the failed acquisition bid by PhonePe, put immense financial pressure on the company.

Lender’s Pullout Game: With the regulatory concerns, lending partners like NBFCs started withdrawing support, making it difficult for ZestMoney to acquire funding and sustain its operations. Some analysts point to internal issues like over-leveraging and overexposure to specific sectors as contributing factors.

Despite raising approximately $5-7 million in seed funding in July, the company's financial struggles persisted, culminating in the decision to shut down. Media houses reported that ZestMoney terminated over 100 employees during a transitional phase.

ZestMoney raised a total of $125 million, including debt financing, but experienced a decline following the implementation of new guidelines for Buy Now Pay Later (BNPL) companies by the Reserve Bank of India in June 2022. The regulatory measures prohibited non-bank prepaid instrument issuers from loading instruments with credit lines.

ZestMoney intends to retain a minimal finance and legal team as part of its wind-down strategy. This team will focus on selling the business's remaining assets to a suitable buyer and overseeing the closure process. Although it is unlikely to attract interest from major fintech companies, there is speculation that a traditional NBFC might consider acquiring the technology in a potential firesale.

THE (K)RÉME

THE LAST SAVE…

The BNPL market in India is challenging due to factors like low credit card penetration, regulatory uncertainties, and the need for alternative data points to build credit profiles for a large population without traditional credit scores. These challenges make it difficult for BNPL startups to thrive. There are still some companies in this space, like Axio and LazyPay, attempting to navigate these challenges.

India's rapid adoption of digital payments led to a booming digital lending scene, including BNPL. Concerns over unregulated lending practices and rising defaults prompted the Reserve Bank of India (RBI) to step in with stricter regulations:

KEY REGULATORY MEASURES:

Guidelines for Digital Lending (Aug 2022): These introduced restrictions on loan tenures (maximum 90 days for BNPL), KYC norms, lending partner licensing, and data-sharing practices.

Enhanced Due Diligence for LSPs: Before partnering with Lending Service Providers (LSPs), REs must conduct thorough due diligence, considering factors like technical abilities and data privacy policies.

Direct Transaction Execution: All loan servicing and repayments must be executed directly in the bank accounts of the regulated entities (REs), without the involvement of any third-party accounts.

Cap on Loan Repayment Cycles: Limiting BNPL to a maximum of three consecutive cycles aims to curb debt spirals.

Cooling-off Period: Mandates a 48-hour window after loan approval for borrowers to opt out before incurring charges.

Prohibition on Automatic Credit Limit Increases: There should be no automatic increase in credit limits without the explicit consent of the customer.

Grievance Redressal Mechanism: Establishes a mechanism for customers to address complaints against digital lenders. REs must appoint a nodal grievance redressal officer for a fintech/digital lending-related complaints. If a complaint is not resolved within 30 days, borrowers can file a complaint over the Complaint Management System (CMS) portal under the Reserve Bank-Integrated Ombudsman Scheme (RB-IOS).

Annual Percentage Rate (APR) Disclosure: REs are required to disclose the all-inclusive cost of digital loans as an APR upfront.

Data Privacy and Security: REs are responsible for ensuring data privacy and security. Data collection must be need-based and with explicit borrower consent. Personal data storage is restricted and should be located within India.

Credit Information Reporting: Any lending done through digital lending applications (DLAs) must be reported to Credit Information Companies (CICs), irrespective of its nature.

Regulatory Compliance: REs must comply with various technology standards and regulatory requirements for cybersecurity, set by RBI and other agencies. These regulations aim to mitigate risks such as mis-selling, unethical practices, and data privacy breaches in the digital lending ecosystem, ensuring a safer and more transparent environment for borrowers.

IMPACT ON “BNPL” STARTUPS:

A shift in Business Model: Shorter tenures and stricter norms forced BNPL players to pivot to larger-ticket purchases or other financial products.

Increased Compliance Costs: Implementing new regulations added a burden on smaller startups.

Consolidation Likely: The stricter environment may lead to consolidation in the BNPL industry.

INDIAN “BNPL” LANDSCAPE:

Dvara Research: The Costs of Using Buy Now, Pay Later (BNPL) Products (July 2022): Analyzes hidden costs and customer experiences with BNPL in India.

Finextra Research: The India Policy Series: How the RBI Guidelines will impact digital lending models (Nov 2022): Examines the impact of regulations on BNPL models and the future of the industry.

EY: Unleashing potential: the next phase of digital lending in India (Sept 2023): Provides insights into the evolution of digital lending, including BNPL, and future opportunities.

McKinsey & Company: Buy Now, Pay Later: A Boon for Borrowers and Retailers (Feb 2023): Examines the global BNPL landscape and its potential in emerging markets like India.

The (K)inK.

“Internet piK of the week”

What would happen if “Pocket Telephones” were to be invented?

A 97-year-old comic Klicks it all…“Zest Nahi, Adjust Karo.”

(The Last of Zest…)

The BNPL market in India is expected to reach around USD 14.3 billion in 2023 and is forecasted to grow steadily at a compound annual growth rate (CAGR) of 12.2% from 2023 to 2028.

By 2028, the market value is projected to reach approximately USD 26.1 billion. There is a notable demand for BNPL services in the travel segment. For example, SanKash, a firm specializing in travel-related BNPL services, reported a significant increase in travel loan amounts in the fiscal year 2023.

Prepaid payment instrument providers like Paytm are leveraging BNPL as a strategy to drive growth. In Q2 FY23, BNPL loans constituted a major portion of the loans disbursed by Paytm. The trend of BNPL adoption is especially pronounced in Tier II and Tier III cities of India.

Digital loans were booming, but the party's on pause - thanks to new rules from the RBI and pressure from folks worried about unfair lending. Banks and NBFCs, the loan providers, are now cautiously reconsidering their partnerships with online lending platforms.

Why the fuss? Well, personal loans through these platforms grew like crazy, fast. This worried the RBI, who kept telling banks and NBFCs to be more careful. Even some groups stepped up, saying these loans could be unfair and the debt collection a bit much.

Then came the RBI's new move: changing the risk weights for these loans. This means these loans are riskier now, making them less attractive for banks and NBFCs. Paytm, a big fintech player, says it'll be fine, but smaller companies doing small loans and BNPL (Buy Now, Pay Later) might struggle.

But it's not all doom and gloom. Fintechs are realizing following the rules is key, not just an option. They're learning that just setting up a digital lending platform isn't enough. Google Pay is working harder on partnerships, and CRED is offering more loan options.

The market's still crowded with loan platforms, but the RBI's cautionary steps aim to avoid bigger problems down the line. It's a new game now, and only time will tell who wins in this reshuffled fintech world.

Riddle me this:

Zest Money promised easy to pay,

For yoga pants and lattes all day.

But dreams of leggings in every hue,

Turned to debt-filled blues, a sad "boo hoo."

Regulations tightened, the party did stall,

Loan approvals slowed, a financial wall.

Founders took flight, investors in dread,

Zest Money crashed, with feathers all shed.

So riddle me this, with a mischievous wink,

Who promised the moon, yet couldn't even think,

That credit and cash, a delicate dance,

Would leave customers stranded, in a financial trance?

Zest Money, oh Zest Money, your reign was too brief,

Leaving a cautionary tale, for startups with grief.

Remember, dear friends, before you soar high,

Build a foundation strong, so your wings won't cry.

~vivan.