🪓ZUDIO vs. ALL: Who's your OOTD WARrior?

[#15] Tale of Chaos: 2 Players. 4 Competitors. $10 Billion Fast fashion Market. And a GenZ-Rizz-Dilemma. Who's your OOTD? Who's winning this cluttered "Ultra-Value" Fast fashion Royal Rumble in India…

“Advertising has us chasing cars and clothes, working jobs we hate so we can buy shit we don't need. We're the middle children of history, man. No purpose or place. We have no Great War. No Great Depression. Our Great War's a spiritual war... our Great Depression is our lives. We've all been raised on television to believe that one day we'd all be millionaires, and movie gods, and rock stars. But we won't. And we're slowly learning that fact. And we're very, very pissed off. ”

— Chuck Palahniuk, Fight Club

🔔*ting ting ting*🔔

LAAADDDDDIIIEEEEEESSSSS & GEEEENNNTTTLLEEEEMEN!!!

Get ready for the FASTEST, the FIERCEST, the most FASHIONABLE ROYAL RUMBLE you've ever witnessed! In the left corner, hailing from the house of Tata, bringing budget-friendly style to the masses—it’s ZUUUUDDDDIIIOOOO!!!

And in the right corner, repping Reliance, the Gen Z warrior, setting trends ablaze—it’s YOOOOUUUUSTA!!!

LET ME TELL YOU SOMETHING x2…is there any point fighting this match when we know “Z” is the last letter of the Alphabet. And “Y” just before it. But that’s the best part, they both belong to theALPHAbet and no one bets against them. But will you?

Morning iKyu-riskers! What’s the 2nd rule of Fight Club? Shhhh!.

As the great ‘VIRUS’ (Viru Sahastra Buddhe) once said “no one remembers the person who came 2nd.” or an idea. Perfect.

Competition in India is like relic of Time, it decays as it passes by.

The one survives the game of relevancy…wins. True for sports, businesses, life. But why ‘relevancy’ is important on the first place? That too in India? Mystery remains for all Business builders. Is it the Morden age that governs this fixture or is it something else…

Competition in a commodity business is a flush game. Either go down with it or be taken down, nothing in between. When everyone starts selling the same thing, no one is selling anything. An important lesson for people pseudo-hungry for competition.

THE (K)EY NOTES:

The (K)urrent: The “UNDER 999”The (K)réme: TIER - THE GOOTD of WARThe (K)inK: ONE SIZE FIT ALL

So when you discuss outfits with your bros & sissies, what’s the focal point of discussion — Is it the fabric that lures you? Or is it the texture? or is it the origin of the fabric that made you buy it? Is there any thing value-driven insight discussion when we talk about our ‘curated fits’?

None. So what do you look for when you’re shopping for clothes?

The Price Tag.

Basic Indian behaviour in an Apparel store (online or offline) is to look for a price tag. We prefer “affordability >” over functionality, utility or need. And that makes Indian clothing industry a Chakravyuh — A labyrinth with infinite entries (different price segments) and exits (catered by every new segment brands).

This ‘Chakravyuh’ sparks dilemma.

Dilemma breeds Competition.

Competition is superseded by Advertisement.

And “Advertising” has us chasing cars and clothes (you know)…

Feeling trapped?

Lets’ brutally breakdown🪓 these chains of Clothing Industry and figure out whether India is ready & suited up for a stellar Fast-fashion Industry disruption…

THE (K)URRENT

THE “UNDER 999”…

"If I had asked people what they wanted, they would have said faster horses."

— Henry Ford.

Caption this: a bustling Indian market, alive with the buzz of young shoppers eager to snag the latest trends without breaking the bank. But which shrine to surrender to. Every corner you move into, you find a brand fit for you. Every brand has variations where you like some, hate almost everything. And as a GenZ, can only decide after your affordability meter i.e. The Price Tag justifies your need…

So where do you look?

Buttons Up. Occupy your intellectual trial room, for the brutal business breakdown🪓 of India’s fast fashion disruption…

The “9.9.9” Store

Fast Fashion Industry lurkers found an interesting consumer psychological insight: The psychological appeal of the 999 price point is juicy. It creates a perception of affordability while hovering just below the ₹1000 mark, a significant psychological barrier for many Indian consumers. This pricing strategy taps into the value-conscious mindset of the Indian middle class, who seek style without breaking the bank…

That’s where Tata-owned Zudio sweeps the floor. India’s favourite fast fashion Goliath, the true "Everything Under 999." pioneer is an all season destination for all your shades. What else would you do, if not surrender?

It's not just a tagline; it's a strategy that’s changing the way India dresses. In a country where every rupee counts, this pricing model is like a golden ticket, inviting millions to step into the world of fast fashion.

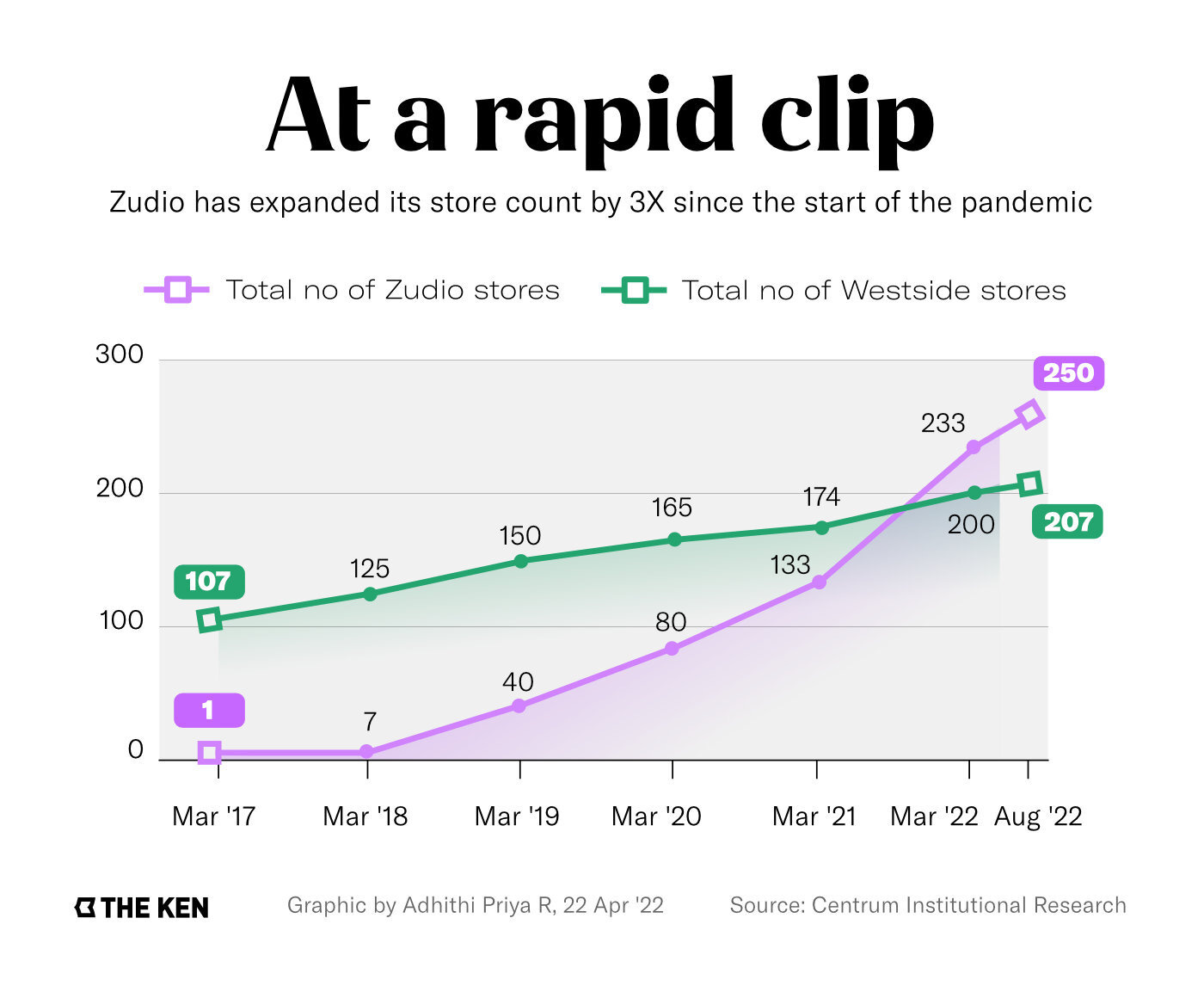

This pricing strategy has proven to be a masterstroke, especially in a market where the average consumer is highly price-sensitive yet increasingly fashion-conscious. For a country with over 50% of its population under the age of 25, this approach taps directly into the desires of young Indians who crave trendy, affordable clothing. Zudio, with its rapidly expanding footprint of over 300 stores, has leveraged this strategy to propel itself into the spotlight, growing its market share by appealing to the masses in tier 2 and 3 cities. These are areas where consumers are eager to stay on-trend but have traditionally been underserved by premium brands.

But this isn’t just about low prices—it’s about smart business. By tapping into the aspirations of India's growing middle class, especially in the often-overlooked tier 2 and 3 cities, these brands are rewriting the rules of fashion retail. As disposable incomes rise and the influence of social media permeates even the smallest towns, the demand for fast fashion has skyrocketed. The Indian fast fashion market was valued at approximately ~$10 billion in 2023 and is expected to reach USD 28.8 billion by 2030, growing at a staggering CAGR of 16.5%.

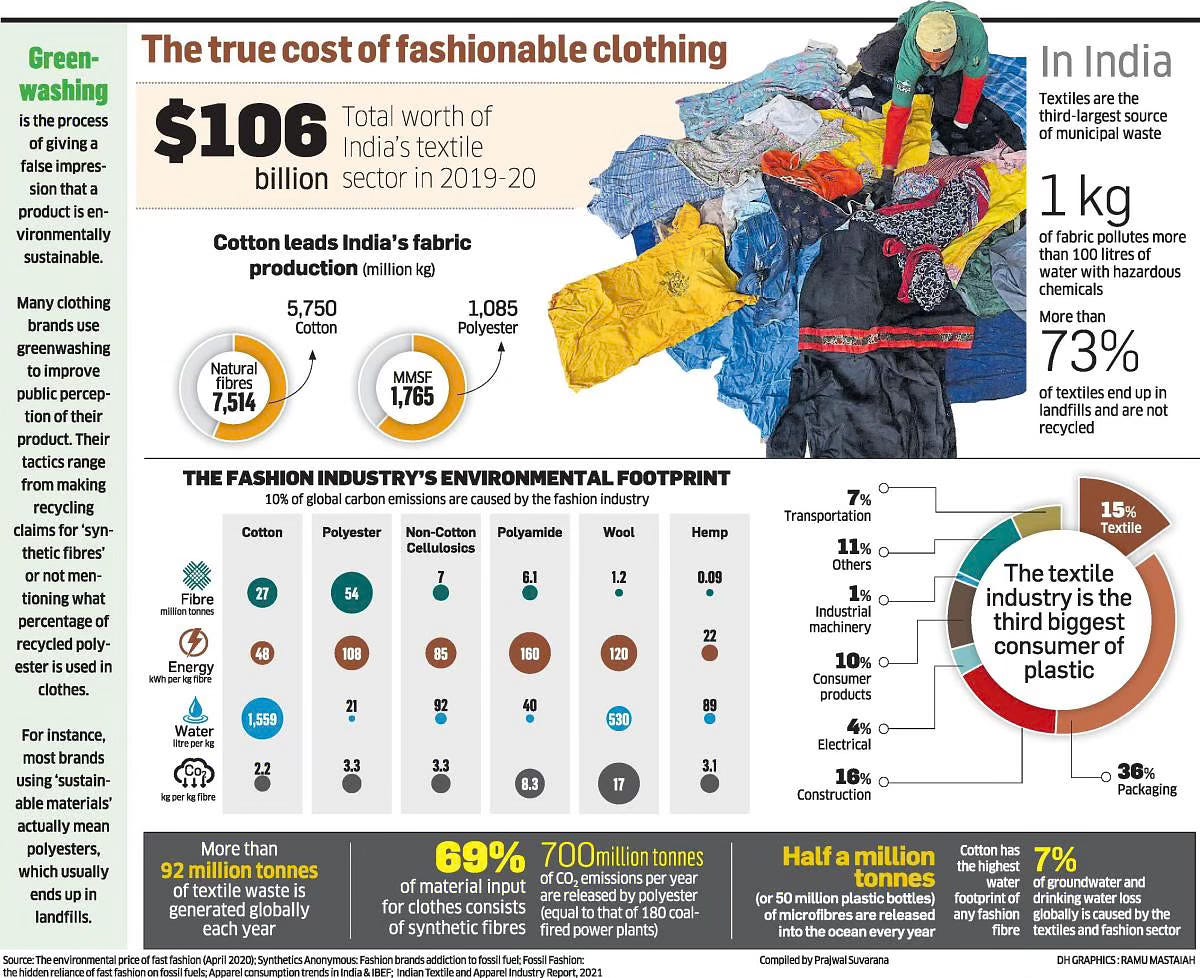

The relentless focus on affordability raises questions about sustainability, both in terms of environmental impact and long-term brand loyalty. Fast fashion, by its nature, encourages rapid consumption, which can lead to waste and a disconnect between consumers and the brand.

As these companies race to the bottom on price, the question remains whether they can maintain this momentum without sacrificing the quality and ethical practices that increasingly matter to consumers.

In the short term, the "Everything Under 999" strategy is a winner, driving foot traffic and sales across the country. But as the market matures, the true test will be whether these brands can evolve, offering not just affordability but also a sustainable and meaningful connection with their customers.

THE (K)REMÉ

“TIER” — GOOTD of WAR…

With fast fashion pacing up to penetrate India’s fabric of adopting new age design with a low cost variability is a problem to solve for these brands. And no one’s ready to slow down.

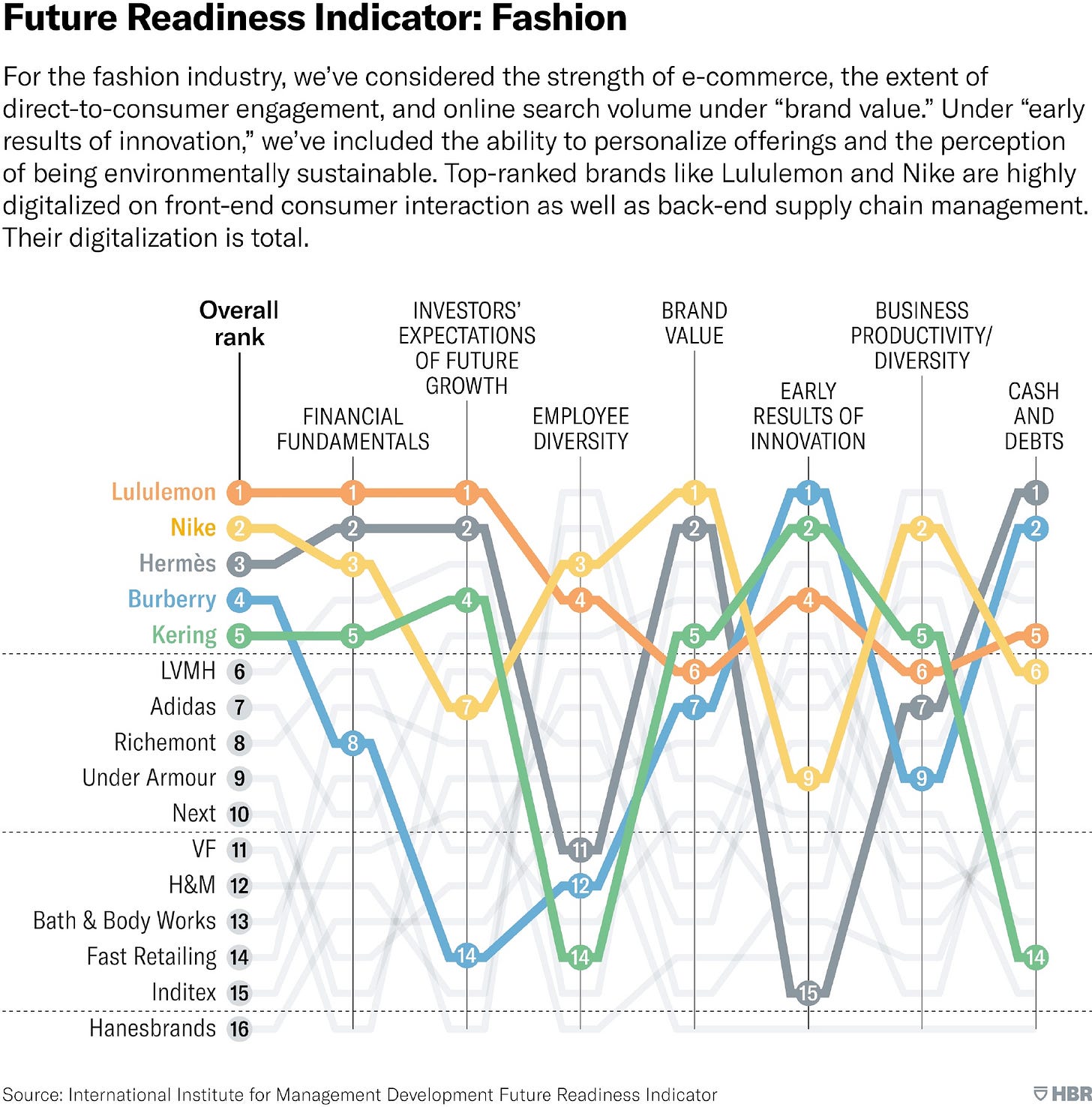

In India’s fast fashion landscape, different tiers of consumers gravitate towards brands that best align with their economic realities and fashion aspirations. This addiction of innovating in the "Ultra-Value" brand segment is the new high of Zudio and it’s competitors. Zudio has mastered the art of catering to tier 2 and 3 cities, where price sensitivity is paramount.

By focusing on affordability, Zudio’s "Everything Under 999" strategy has successfully captured a large segment of consumers who seek trendy yet budget-friendly apparel. The brand’s rapid expansion, supported by nimble supply chain management, allows it to offer a high turnover of styles at competitive prices, driving its popularity in these regions.

But we have a new player in this TIER…

A RELIANCE REBEL…

Yousta, Reliance Retail's newest foray into the fast fashion segment, is rapidly emerging as a formidable competitor to established players like Zudio in India's "ultra-value" fashion market. Launched in 2023, Yousta is designed to appeal to the youth demographic, offering all its products below Rs. 999, with a significant portion priced even lower, under Rs. 499. This aggressive pricing strategy directly targets the price-sensitive yet fashion-conscious young consumers across India.

Yousta's strategy is not just about low prices—it's about combining affordability with trendiness and technology. The brand features tech-enabled store layouts with self-checkout counters, QR-enabled information screens, and offers fresh, weekly updated collections under its 'Starring Now' series, ensuring that it stays ahead in the fast-paced fashion game. This focus on innovation and customer engagement is a strategic move to differentiate itself in a crowded market.

Reliance Retail's plans for Yousta are ambitious, with the company aiming to open 200-250 stores across India, a move that could significantly disrupt the market. Given Reliance’s vast retail network and the synergy with its e-commerce platforms like Ajio and JioMart, Yousta is poised to scale quickly, leveraging both online and offline channels.

The broader impact on the industry is significant. The "ultra-value" segment is expected to see intensified competition, with brands like Zudio, Yousta, and others pushing the boundaries of affordability and accessibility. This competition is likely to drive innovation, but it also raises questions about sustainability and long-term profitability in a market increasingly driven by razor-thin margins.

As Yousta continues its expansion, the future of India's fast fashion industry looks dynamic but challenging. The success of these brands will depend on their ability to maintain quality and innovation while scaling rapidly in a highly competitive environment. The industry is poised for growth, but the path forward will require balancing cost efficiency with consumer satisfaction and ethical practices.

On the other hand, brands like Zara and H&M cater to the urban middle class and affluent consumers in metro cities, who prioritize brand prestige and are willing to spend more for quality and trend leadership. These "Mid-Value" and "Premium" brands capitalize on brand loyalty and customer recall, offering fewer but more exclusive collections that resonate with their target market.

The (K)inK.

“Internet piK of the week”

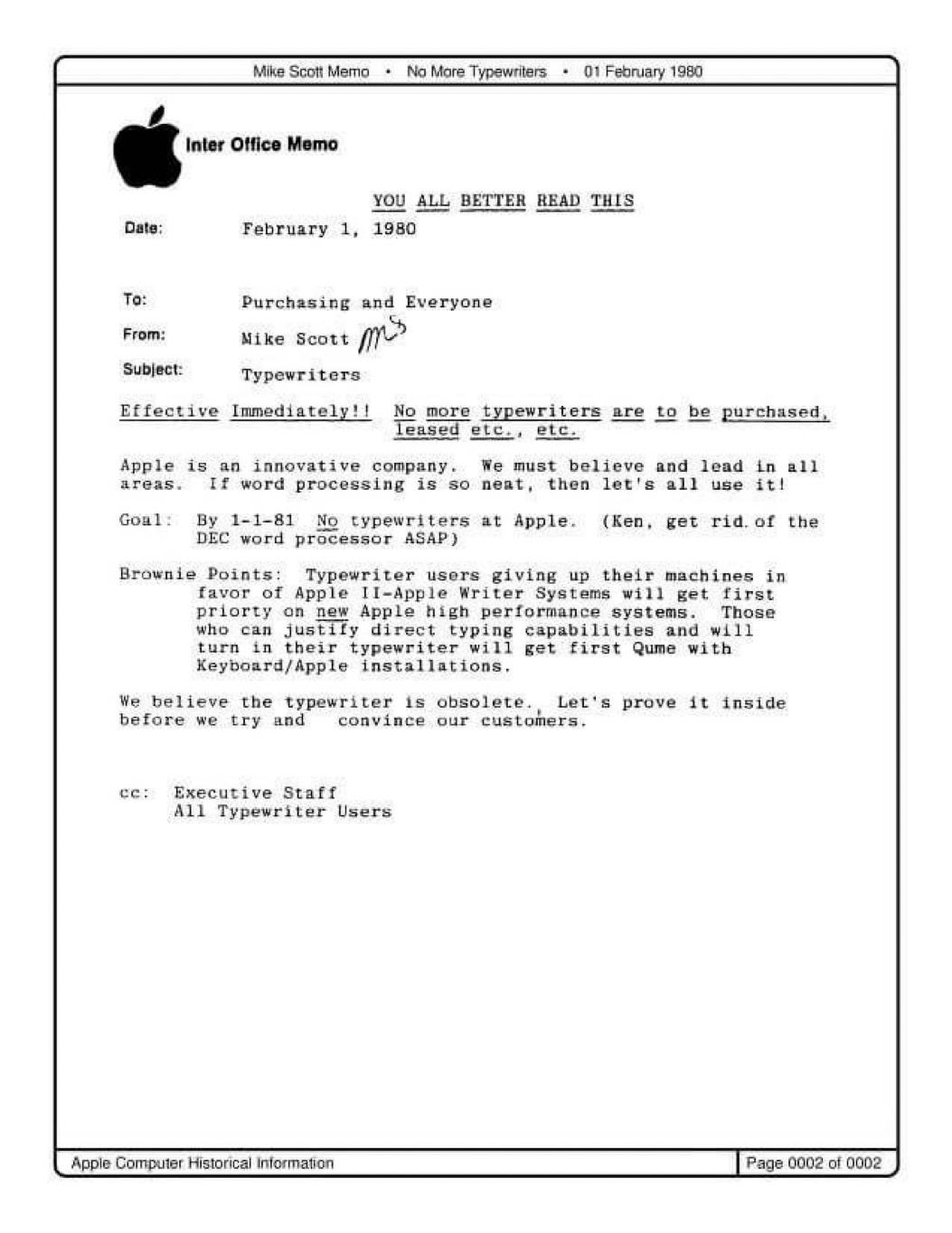

Apple’s Inter Office Memo. Circa 1980. Titled “No More TYPEWRITERS”…

GENZ’s OOTD

NOTONE SIZE FIT ALLAfter the success of Tata Group’s Zudio & Reliance Industries slicing up the ‘cute fits’ market to it’s maximum. New players are sprouting which already have a mid-value segment footprint in India. INTUNE is the rookie.

But I wondered that when will disruption wake up the European Union to come up with some diabolical concern about future and earth and present it as a futuristic mission to be complied by all…

So when all these fast fashion are quickly zapped onto yourself and thrown out in the same manner, where do they go when they’re no longer wore? most probably a landfill.

The European Union, home to fast-fashion giants Zara and H&M, wants to stop that. It’s framing rules to ensure all imported textiles are sustainable by 2030. But experts say the rules are too vague. And we know this India’s volatility can’t be matched up by any regulations at the moment. We are far too swayed when it comes to flex our manufacturing muscle.

Finding indigenous powers are another feat one should be focusing on.

The Tatas, Ambanis, and Adanis—India’s business titans—have poured billions into building sprawling online consumer empires, yet success has been fleeting. Tata Trent’s Zudio, with its sharp focus on Gen-Z, stands as a rare win, while Reliance’s Digital empire dominates India’s organized electronics retail. But not everything glitters. Tata’s much-hyped super-app, Neu, is floundering, struggling to find its footing even after two years. Meanwhile, Reliance’s JioMart, touted as the next big disruptor in FMCG distribution, has failed to deliver the seismic shift it promised.

These giants have the deep pockets to dive into the cutthroat realms of online payments and quick commerce. But here’s the brutal truth—profitability remains a distant mirage. Among them, Reliance has the edge, at least for now, but the path to dominance is fraught with challenges that even their vast fortunes may not easily overcome.

The game is on, but the stakes have never been higher.

*Now, go back into scrolling your GRWM guilty pleasures😏*~vivan.